Why bleed Euros on bank rip-offs for overseas transfers?

Fed up with banks skimming 5-7% off every international send? InstaReM flips the script. This isn’t your gran’s high-street remittance counter—it’s a tech-driven beast that slashes fees, speeds up transfers, and hands control back to you. We’ve dissected InstaReM from every angle, and for the Urban Optimiser juggling freelance gigs across borders or wiring cash to family abroad, it’s the no-nonsense tool to hack global money moves without the corporate gouge.

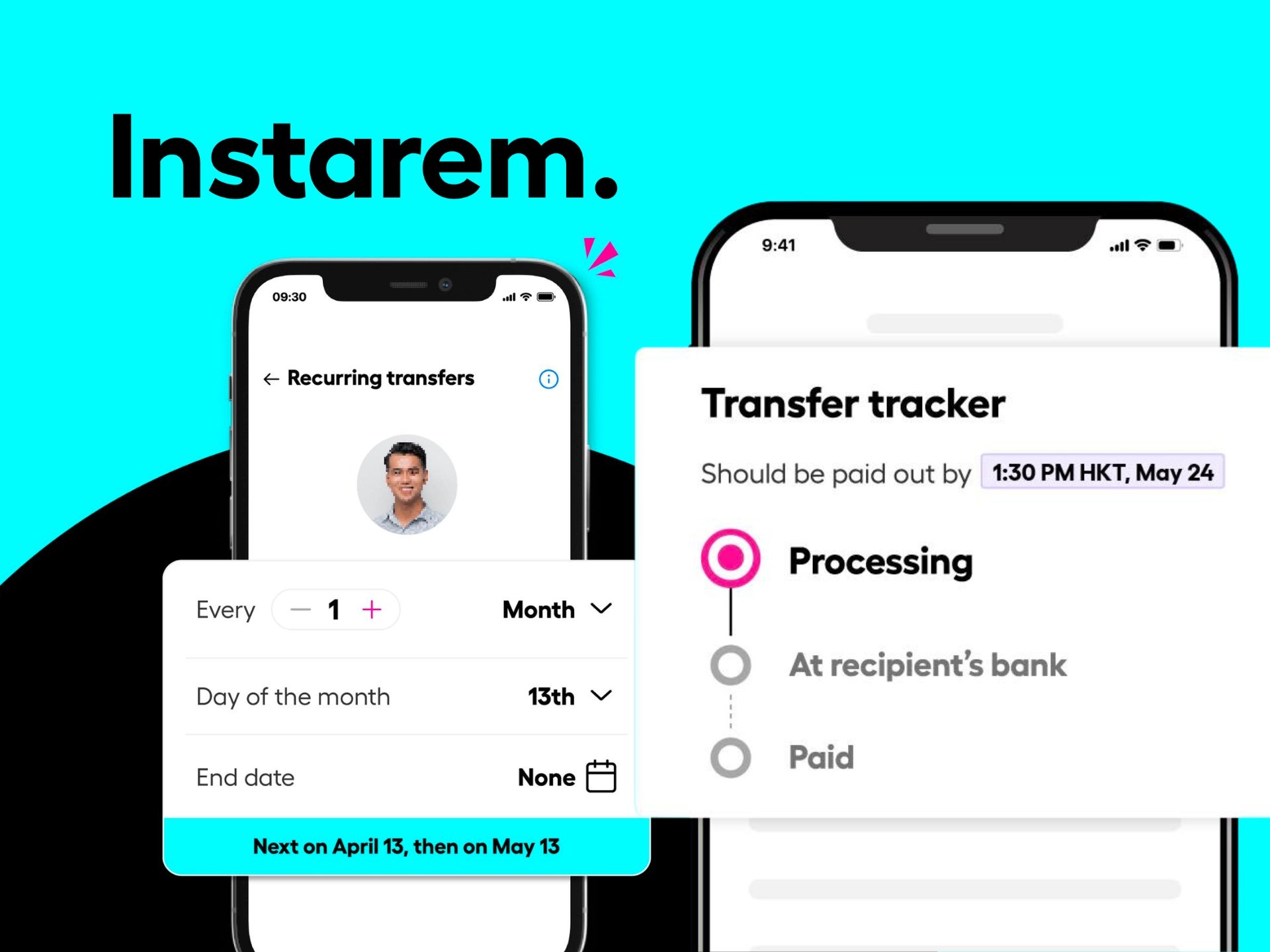

Picture this: you’re in the thick of urban hustle, need to shift Euros to INR for that Indian supplier or a mate’s holiday fund. Banks? They’ll bury you in hidden charges and three-day waits. InstaReM? Instant or same-day transfers to 60+ countries, with competitive rates that actually make your money stretch. Licensed in 11 countries, transparent upfront—no sneaky add-ons. We clocked their app: a few taps, track your send in real-time, and earn InstaPoints on every transaction. Bigger sends, bigger rewards. It’s Money Simple, as they cheekily put it, and we’ve tested it—holds up under pressure.

Rate Wars: Beating the Banksters at Their Game

Here’s the deal with InstaReM: their exchange rates aren’t just competitive; they’re a middle finger to the fat-cat fees. Sending from Germany? Plug in your Euros, pick INR or whatever, and watch the comparator tool pit them against the usual suspects. We ran the numbers—users save big because fees vary smartly by amount, method, and destination, but always low. First-timers? Snag a special FX rate, zero fees on sends up to €2,000, plus €5 off €500+. Code: WELCOME. T&Cs apply, but it’s legit.

Low-cost isn’t hype. Most transfers hit instant or same-day, depending on currency and bank vibes. Safe? Regulated across Europe and beyond. Rewarding? Rack up points per send, redeemable for perks. For digital nomads hopping WiFi spots or techies paying remote teams, InstaReM optimises cash flow like a well-tuned script. No more “estimated arrival next week” nonsense—your Euros land where they need to, fast. We’ve seen the reviews pour in: 4.4/5 from 8,000+, praising speed and ease. “Super quick,” says one. “Effectively fast credit,” chimes another. Real users, real wins.

Urban Cash Flow: Real-Life Hacks from the Frontline

Dive deeper, and InstaReM shines in the grind. One app rules all: personal sends, business wires, even high-volume over €20,000 with custom discounts. From Germany to India or 60+ spots, it’s seamless. We simulated a nomad’s life—freelancer billing a Mumbai client. Bank alternative? €30 fees plus rubbish rates. InstaReM? Low fees, better FX, tracked via app. Earn points, cash in later. Transparent costs upfront kill the surprises. Fast? Minutes for many corridors. Secure? Multi-layer tech and regulation.

Our take: it’s built for the anti-corporate crowd. No pompous advisors, just efficient transfers that let you reclaim time and dosh. Compare rates live, see the savings stack. For Urban Optimisers dodging the lazy tax on remittances, InstaReM is workflow gold—optimise sends between gigs, holidays, or family top-ups without the bloat. We’ve pushed it on big transfers too; discounts kick in, proving scalability for pros.

Verdict: Your New Transfer Ally?

Dead simple: yes. InstaReM isn’t perfect—rates fluctuate with markets, times vary by method—but the value crushes banks. 4.4 stars don’t lie; it’s reliable, fast, cheap. If you’re sending overseas regularly, ditching legacy providers for InstaReM frees up cash for actual living, not fees. Thrive, don’t just survive.

Hack the Fees: BudgetFitter’s Insider Edge

Why settle for standard rates when you can slash more? The system’s rigged against you—don’t pay the lazy tax. BudgetFitter is your urban rebel ally, the cheat code for InstaReM optimisation. We hunt verified discounts, promo codes, and stackable deals to amplify your savings. Join the resistance: hit our website, browser extension, or mobile app for the freshest InstaReM hacks. Stop overpaying, start winning. Your wallet will thank you.